Posts Tagged ‘cumulative tick pro’

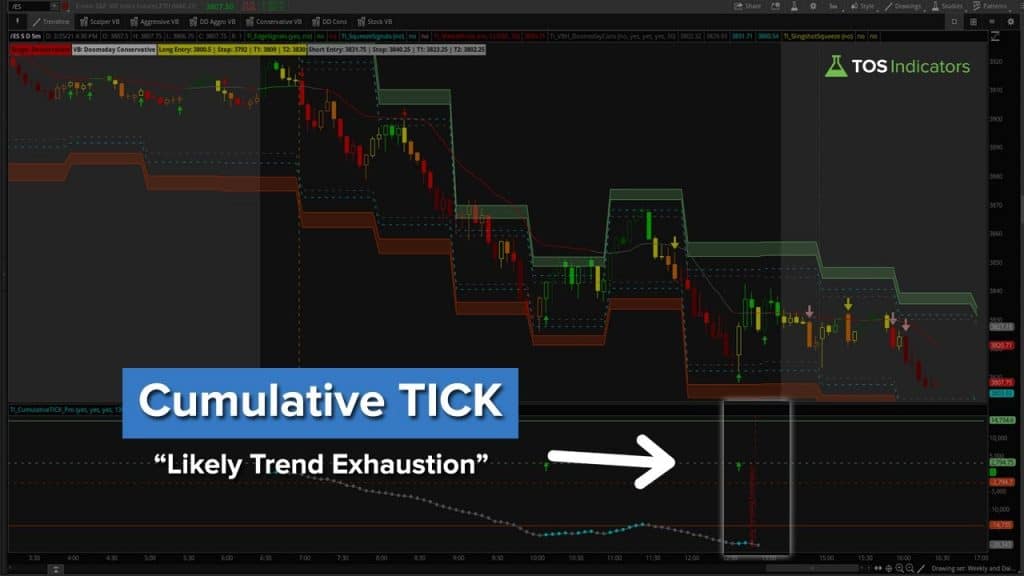

Cumulative TICK Signal for a 0 DTE Options Trade in SPY

The Cumulative TICKs signaled that we were at a point of likely trend exhaustion on Thursday, headed into Friday. Let’s use this information to set up a 0 DTE option trade.

Read MorePre-Election Volatility in the S&P 500

With the election tomorrow night, we’re starting to see some of the “funkiness” that we would expect from pre-election night volatility in the S&P 500.

Specifically today, we had the market internals suggest to us to expect more buying pressure as the day progressed. We also saw a steady rise in the Cumulative TICK indicator, suggesting more buying than selling pressure.

However, when you contrast that with what price action actually did, we’ll see a much different story. Instead of price go

Read More2 Ways to Identify Trending Markets

We have two easy ways to discover likely trending markets, using data-driven tools that we’ve created. In today’s video, we’ll discuss both of those methods and break them down with some examples.

Our first method of identify trending markets is built inside of the Volatility Box. We’ve used data here to identify specific price action clues in the first few hours of the market being open, to determine whether the market is likely to trend.

Today, we had Copper give us the indication that we sh

Read MoreRTY Futures Day Trade Walkthrough

We’ll walk through a “picture perfect” setup in the Russell Futures (RTY), which set up today in the 9-10am PT hour.

During the middle of the east coast lunch time, we had the Russell hit our dashboard, when price action reached our Volatility Box entry lines. This gave us an opportunity to get short, once we had the Edge Signal confirmation.

In today’s case, we had several different components which supported the short:

1. We had multiple Edge Signal confirmations (our oversold / overbought c

SPY Gap Fill With Cumulative TICK Data (OTM Put Debit Spread)

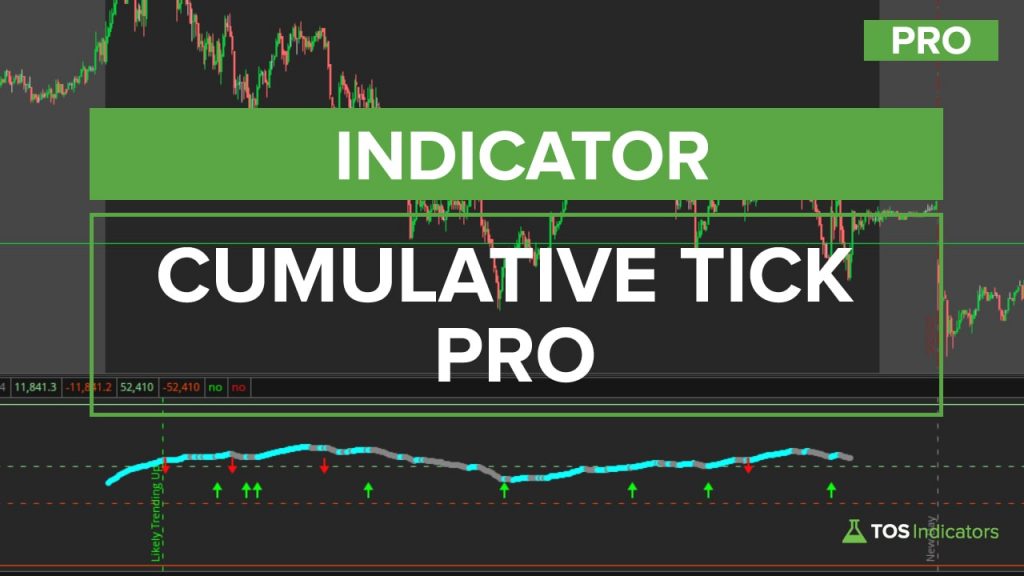

Similar to last week, we’re going to continue using the Cumulative TICKs to find clues around what to expect in the S&P 500 for tomorrow.

With the close today, we had our Cumulative TICK Pro indicator suggesting that we had a likely bullish trend exhaustion. Typically, this is met with a reversal the next day. We had something similar set up last Thursday, with a bearish trend exhaustion signal, and saw a nice rally to close on Friday.

We’ll use this data and observation to build a trade in S

Read MoreBullish Reversal Trade Idea in SPY – Market Internals Data

The Cumulative TICK Pro signaled to us to expect a likely bearish trend exhaustion with today’s activity. We’ll use this information to create a game plan for tomorrow’s trading.

Specifically, I’m looking for the bearish trend that we had into the final hours of the market to halt, and reverse into tomorrow. Below, you’ll find a brief game plan that is expanded upon more in tonight’s video.

➡️ WHAT WE’RE EXPECTING:

A bullish reversal, after a morning decline. The Cumulative TICKs suggested t

Cumulative TICK and Volatility Ranges – Day Trading /ES Futures

We had both trend and fade opportunities that set up in the S&P 500 futures (/ES), for high probability trades.

With the morning gap down lower, we had the TICKs consistently signaling selling action. This was easy to see via the Cumulative TICK indicator, with the pro version signaling that we should expect to see a likely trending down move.

Shortly after the notification at 7:00am PT, we had a pullback to our Market Pulse line, giving us a better place to start building a position with ETF

Read MoreCumulative TICK Indicator with Volatility Ranges

Over the weekend, we released our 21st episode of the “How to thinkScript” series, which includes both a free and pro version (which is available for Volatility Box members).

In today’s video, we’re going to use the Cumulative TICK Pro indicator, alongside our updated Volatility Box models to take a look at price action in the indices.

Across the board in the ES, YM, and NQ, we had breaches of our Volatility Box in the 10-11AM PT hour that hit our Volatility Box zones, almost to perfection.

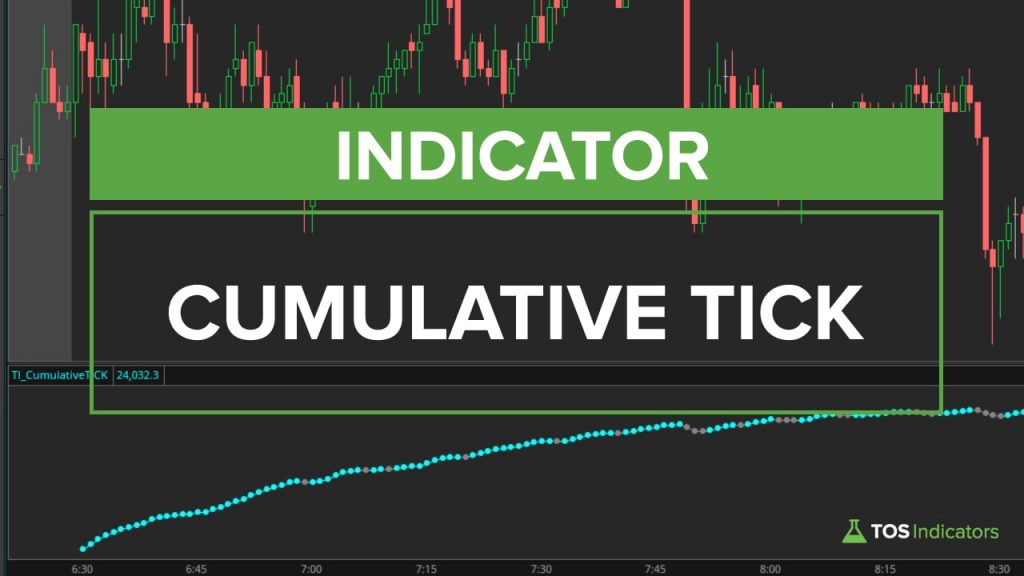

Read MoreCumulative TICK

Build a cumulative TICK indicator to track market internals ($TICK) in an efficient manner, keeping the count.

Read More