Posts Tagged ‘day trades’

5 Oversold Stocks with High Short Interest – Part 4

Out of our original list of “5 Oversold Stocks with High Short Interest, we had the last stock trigger a bullish trend setup today.

Read More5 Oversold Stocks with High Short Interest – Part 3

Out of our original list of “5 Oversold Stocks with High Short Interest, we had 3 more stocks that triggered bullish setups today.

Read More5 Oversold Stocks with High Short Interest – Part 2

Yesterday, we did some weekend homework and scanned for a list of oversold stocks, which also had high short interest. One triggered today, meeting our setup rules.

Read More5 Oversold Stocks With High Short Interest – Part 1

We’ll build a list of oversold stocks, that have high short interest and likely to make a bullish move throughout the week.

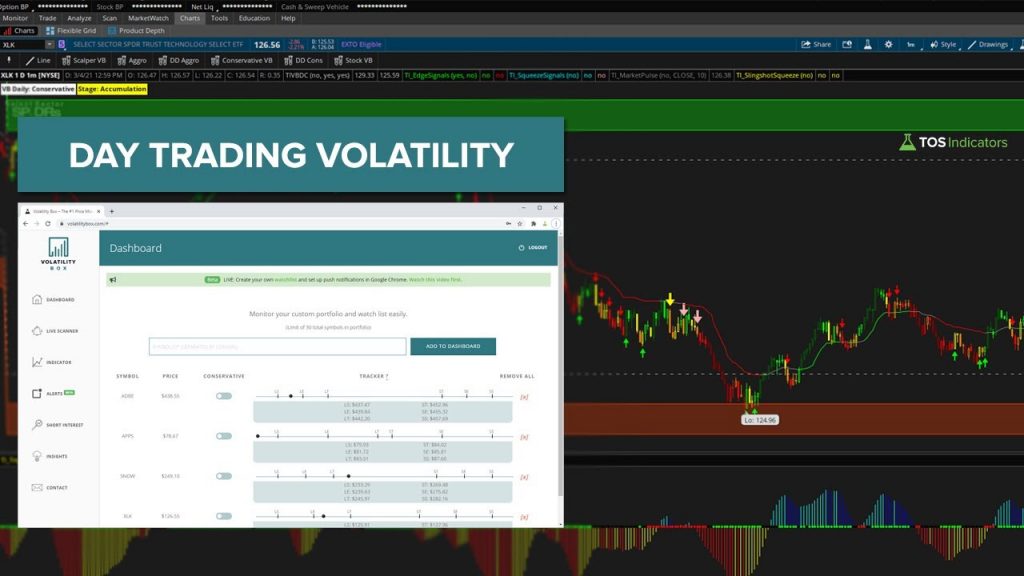

Read MoreTech Stocks Volatility Trading

We’ll start by taking a look at volatility inside of the tech sector ETF (XLK). From there, we’ll start to narrow into tech stocks, taking a look at ADBE, APPS and SNOW.

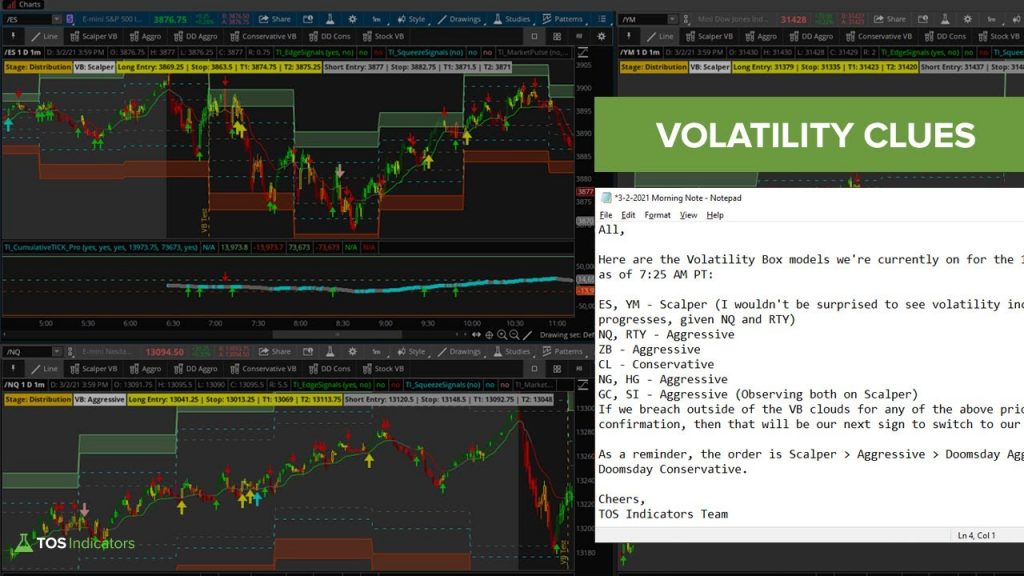

Read MoreWalking Through the Morning Volatility Note

Morning volatility can be a very useful source of information around what to expect for the day, as long as you can read it.

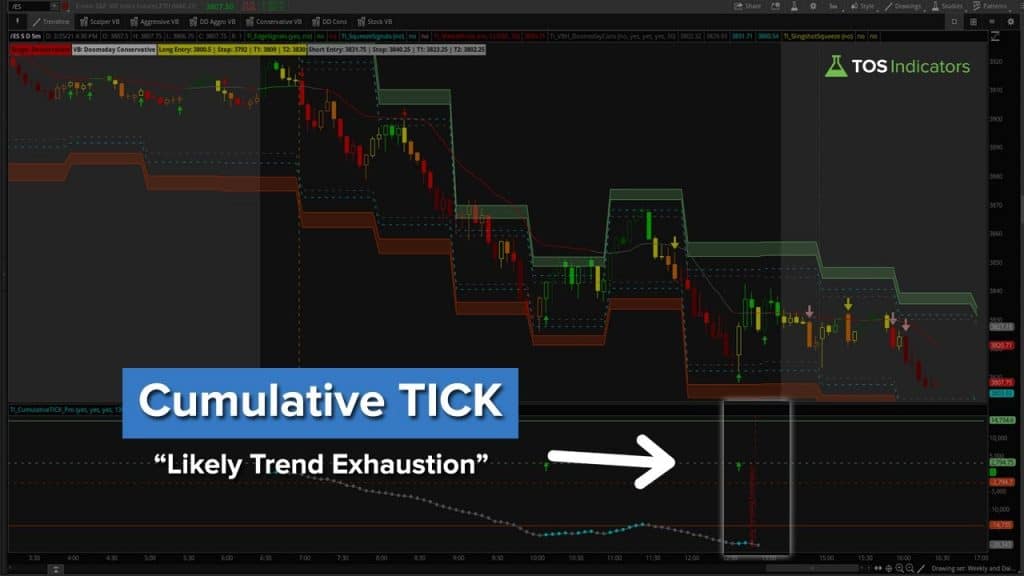

Read MoreCumulative TICK Signal for a 0 DTE Options Trade in SPY

The Cumulative TICKs signaled that we were at a point of likely trend exhaustion on Thursday, headed into Friday. Let’s use this information to set up a 0 DTE option trade.

Read More6 Stocks Showing Strength After Today’s Selloff

We’ll discuss 5 different stocks and 1 ETF that are showing sustained and systematic strength after today’s sell off.

Read MoreNasdaq, Russell and 30-YR Bond Volatility

We had the 30-Year Bond futures giving us an early heads up of increasing volatility in the indices. In this video, we’ll evaluate whether that information proved to be useful in trading volatility on the indices.

Read MoreChop vs. Trend Trades in ES, YM, NQ and RTY

Let’s look at visual examples of chop vs. trend trade setups, using the Volatility Box.

Read More