Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

Comparing Volatility in 10 Futures Markets Post-Selloff

We’ll use the Volatility Box models as a structure, to easily rank the markets.

Building a Watchlist of Weekly Time Frame Squeezes

In today’s video, we’ll use the new Slingshot Squeeze scan and backtester to find profitable weekly time squeeze candidates.

Bullish Daily Squeeze Setting Up on NVDA

In today’s video, we’ll use the new Slingshot Squeeze scan and backtester to

backtest a squeeze in NVDA.

With the backtester, we see that we’ve had 8 bullish squeezes in NVDA, over the past 5 years. With the 8 bullish squeezes, 7 of those have been winners, and 1 was a loser (albeit, a fairly painful loser).

On average, we see that each of the squeeze moves have led to anywhere from a 6-8% move in NVDA from the point of entry. From our current price of $542.33, that takes us to right around

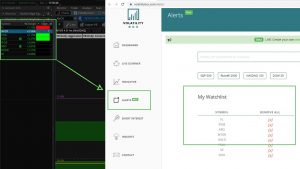

Turning a Watchlist into Volatility Trade Alerts

In this video, I’m going to show you how you can get one step closer to automating your trading process.

In our newest feature of the Stock Volatility Box platform, you can create a watchlist of stocks – these might be stocks in your portfolio, on your radar, or simply just stocks that you like to trade – and let the machine do the rest of the work.

Today, we’ll be using the output of our Bullish Squeeze Signal scan, as our watchlist. Once we copy/paste in our symbol list into the “My Watchlis

Nasdaq Futures (NQ) Trade Walkthrough

In this video, we will do a step by step walkthrough of the 4 major index markets, spending extra time on the Nasdaq futures (/NQ).

We had trade setups that triggered on the Nasdaq and Russell futures, both of which were fairly nice winners. The Nasdaq hit both its first and second targets, while the Russell hit its first target only.

With the S&P and the DOW futures, we did not have any triggers that met our Volatility Box Trade Plan rules. The S&P (/ES) breached our Volatility Box entry li

DIA and JNJ Trade Triggers (and DDOG/TSLA recap)

We’ll do a review of the swing trades in DDOG and TSLA which have hit their first set of targets, along with set up a new trade in DIA.

A reminder as to the idea behind DDOG: https://youtu.be/ZStu8iHr46E

-We had a pullback on the weekly time frame chart to DDOG’s Market Pulse line.

-We also had a bullish Edge Signal (oversold) confirmation signal on the daily time frame chart.

ENTRY: $91.04 (Filled)

TARGET 1: $94.62 (Hit T1)

TARGET 2: $100 (Open)

TARGET 3: $115.30 (Open)

TARGET 4: $125-$1

3 Stock Volatility Trades – DE, SPCE and NVCR

We had 38 stocks that hit our Live Scanner today between the hours of 6:30am – 10am PT (and stayed on for 3+ minutes).

We’ll break down the 38 trades, using a few different lenses:

1. Time in Trade

2. Hour of Trade

3. Type of Model

With today’s stock VB results, we found the sweet spot to be the 5-15 minute zone, with all hours outside of 8-9am PT being positive.

After a higher level overview, we’ll take a look at 3 specific examples:

1. Deere (DE) – Conservative Long; Coming off an earni

Swing Trade in DDOG and Day Trades in S&P 500

We’ll discuss a swing trade setup in DataDog (DDOG), along with breaking down some of the day trades in the S&P 500 (along with one setup for tomorrow).

Starting off with DDOG, we have a pullback on the weekly time frame chart to our bullish Market Pulse line. In addition, we also have a bullish Edge Signal (oversold) confirmation signal on the daily time frame chart.

Here’s the trade parameters for the extensions discussed in the video, along with 4 potential targets depending on how long y

TSLA, RTY and YM Trades

We’ll do a quick update to our TSLA Broken Wing Butterfly trade, along with discuss two futures trades in the Russell and DOW markets.

Starting off with the TSLA broken wing butterfly, we were looking for a pin near the $550 price point, and had built a 530/550/560 broken wing butterfly for $1.55. Today, that same butterfly is currently selling for ~$3.90.

To manage the trade, I’d be looking at a pullback here in TSLA, which would actually be healthy, and help erode some of the theta premium

3 Different Trade Setups in Boeing (BA) Stock

We’ll discuss 3 different types of trade setups that occurred today in Boeing (BA), giving you an opportunity to visualize and understand each one.

The 3 trade setups that we’ll discuss are:

1. Bullish Squeeze and Targets

2. Reversal via the Volatility Box

3. Trending Criteria for Tomorrow

In the first setup, we had a bullish Squeeze Signal along with a bullish Market Pulse, suggesting that we expected the stock to continue trending bullishly. Here’s a video detailing that setup in more detail

FTCH, DIS, AMAT and CSCO Earnings Plays

In today’s video, we’ll cycle through 9 different companies reporting earnings today after the close, to try and find trade ideas. For this exercise, we’ll use our Smarter Earnings indicator, which is available for free here: https://www.tosindicators.com/indicators/smarter-earnings

From the 9 trades, here are our final results:

FTCH – Looking for a bullish gap n go, avg bullish move is $1.69, lowest move is $0.24

DIS – Looking for a bullish gap n go, avg bullish move $3.48, lowest move is $0

Scalp Setup on S&P 500 Futures

By 7 AM PT, the Volatility Box allowed us to get a quick measure of ranking of volatility within the 4 major indices markets.

Today, that ranking was the following (in order from least to most volatile):

1. ES

2. NQ and YM

3. RTY

The S&P 500 was the least volatile market, still respecting our Scalper Volatility Box. Meanwhile, the DOW and Nasdaq had both broken outside of the scalping models, suggesting more volatility than its peer.

The Russell 2000 was the most volatile, having breached ou

Swing Trading Setups (incl. MSFT, SMAR, PYPL, OKTA)

In today’s video, we’ll use today’s sell off to see where we have longer term, swing trade opportunities setting up.

We’ll use our Squeeze Signals scan (built as part of our Squeeze Course), and take a look at the setups using a weekly time frame chart. For those with access to the course, you can also use the backtester here to see actual P/L results.

With a weekly time frame chart, we have opportunity for better trading entries, and maintaining a longer term perspective. Many of these weekly

14 Earning Trade Ideas (incl. AYX, TTD, ROKU, SQ)

In today’s video, we’ll cycle through 14 different earnings charts to try and find trade ideas. For this exercise, we’ll use our Smarter Earnings indicator, which is available for free here: https://www.tosindicators.com/indicators/smarter-earnings

From the 14 trades, here are our final results:

AYX- looking for a gap down, and a fill of that gap off of a beat

MNST – looking for a potential gap n go, avg move $2.33, lowest is $1.21

ROKU – looking for a bullish move — either gap fill or gap n

Post-Election Volatility Trading

With the election being a close race, we had a good deal of uncertainty that translated into volatility for our 4 major index markets.

During the after hours activity as the election results were slowly trickling out, we saw the S&P, Nasdaq, DOW and Russell futures all moving wildly (with the NQ up 3.5%+ in after hours). This same volatility continued into the market place today.

As a result of this volatility, we had a variety of different trading opportunities set up, which we’ll discuss in

Pre-Election Volatility in the S&P 500

With the election tomorrow night, we’re starting to see some of the “funkiness” that we would expect from pre-election night volatility in the S&P 500.

Specifically today, we had the market internals suggest to us to expect more buying pressure as the day progressed. We also saw a steady rise in the Cumulative TICK indicator, suggesting more buying than selling pressure.

However, when you contrast that with what price action actually did, we’ll see a much different story. Instead of price go

Pullback Levels on S&P and Nasdaq

With today’s selling pressure, supported by high volume, we’ll take a look at potential pullback zones in the S&P 500 (SPY) and Nasdaq (QQQ).

Using Fibonacci, we see in the Nasdaq that we’ve hit the 1.618 extension, and are now pulling back. With the S&P, we have open gaps below us, which look like they are likely to be filled.

In case you’re interested, you can also replicate the same process that we use in tonight’s video on the DOW and Russell as well, for pullback zones.

After discuss

Pre-Election Volatility in Index Markets

With the election right around the corner, we’ve had a good amount of volatility enter our 4 major index markets.

In today’s video, we’ll break down the trade setups that we had in the S&P, Nasdaq, DOW and Russell futures markets. If you don’t trade the full size futures, you can also use the micro-futures equivalents, or even the ETF options.

With today’s chop, we had the S&P and DOW really chopping back and forth in between our Futures Volatility Box entry lines.

We triggered both long an

Hourly and Daily Volatility Levels – SPY, QQQ, DIA, IWM

As volatility traders, the 2020 election has led to an increase in not only volatility, but also trade opportunities in many of the major markets.

In today’s video, we’ll contrast our Hourly Volatility Box levels with the Daily Volatility Box levels in the 4 major indices. We’ll take a look at ES vs. SPY, NQ vs. QQQ, DIA vs. YM, and IWM vs. RTY.

We’ll also highlight the “Likely Trending Down” heads up that we received with the Cumulative TICK Pro indicator, and how to trade using market inte

Stimulus Volatility – Futures and Stock Trades

We had stimulus volatility act as a catalyst, leading to some nice trade setups in both futures and stocks.

In today’s video, we’ll cover trades in the 4 major index market futures, along with some stock setups in Pinterest (PINS), FarFetch (FTCH), Baidu (BIDU) and DOW Inc. (DOW).

The first half of the video will focus on the indices trades, where similar to this week, we had 3 winners and 1 loser. We had some nice gains in the /ES, /YM and /RTY futures, while the /NQ was a loser.

With sto