Posts Tagged ‘swing trades’

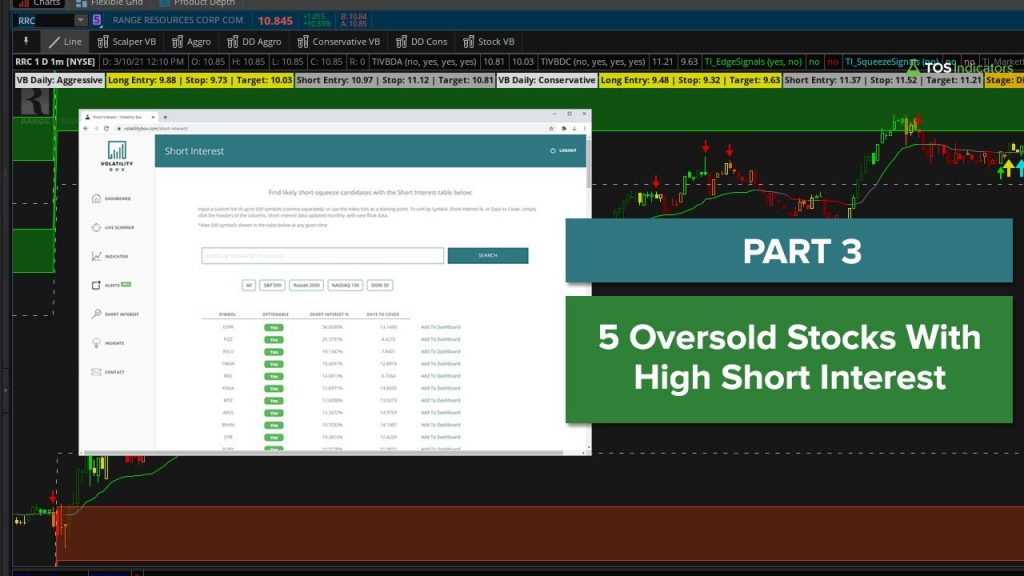

5 Oversold Stocks with High Short Interest – Part 3

Out of our original list of “5 Oversold Stocks with High Short Interest, we had 3 more stocks that triggered bullish setups today.

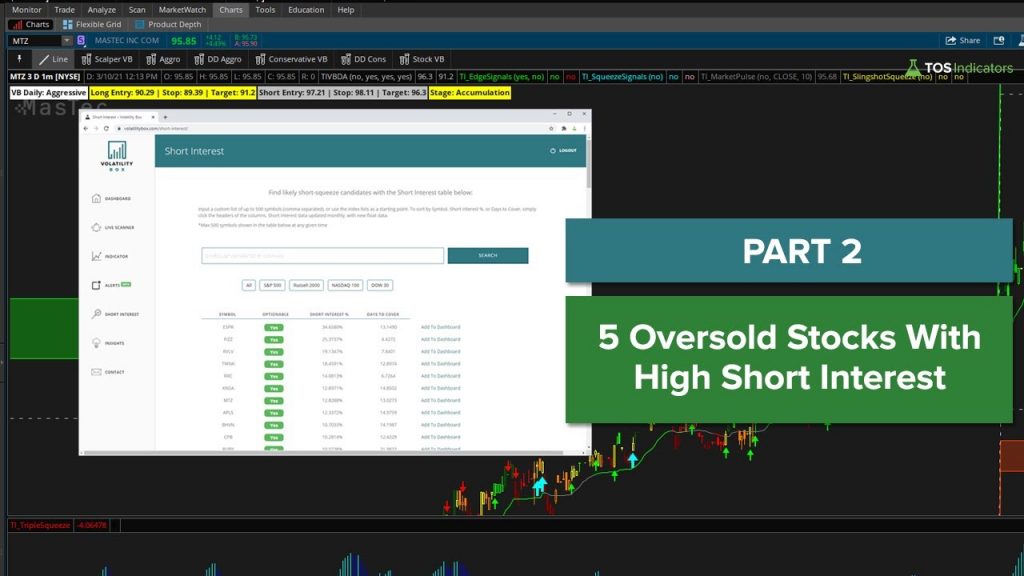

Read More5 Oversold Stocks with High Short Interest – Part 2

Yesterday, we did some weekend homework and scanned for a list of oversold stocks, which also had high short interest. One triggered today, meeting our setup rules.

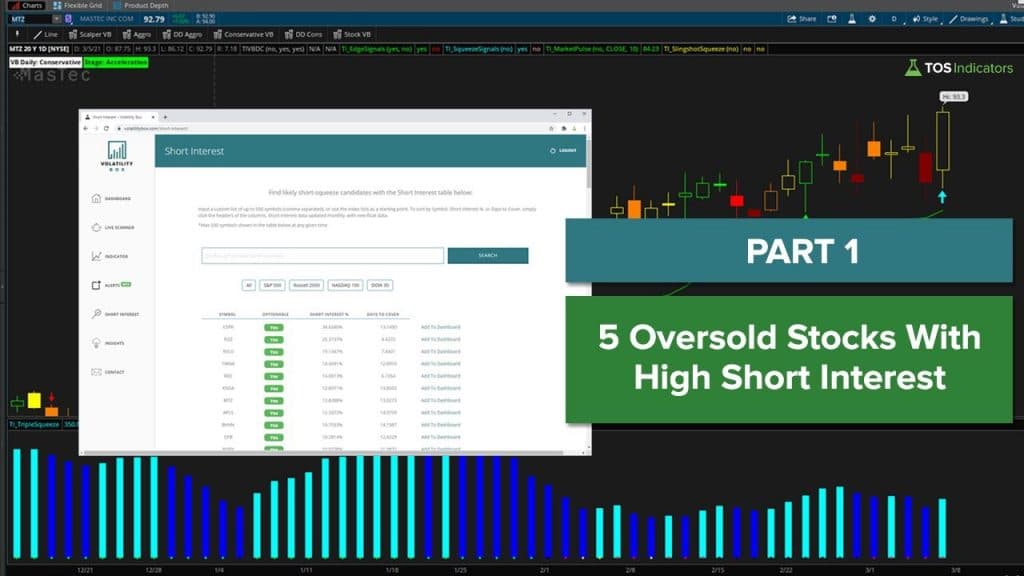

Read More5 Oversold Stocks With High Short Interest – Part 1

We’ll build a list of oversold stocks, that have high short interest and likely to make a bullish move throughout the week.

Read MoreVisa Weekly Squeeze Trade Update

We’ll revisit the swing trade in Visa that we set up in the video on Jan. 14, 2021, which had an entry point of $197.

Read MoreSnowflake (SNOW) – Trade Setup & Option Strategies

Snowflake looks like it’s getting ready to start trending on the bullish side, and we’ll dive a bit deeper into the setup.

Read More3 Swing Trading Setups

In this video, we’ll take a look at 3 swing trading setups in Opendoor (OPEN), Corsair Gaming (CRSR) and Oracle (ORCL).

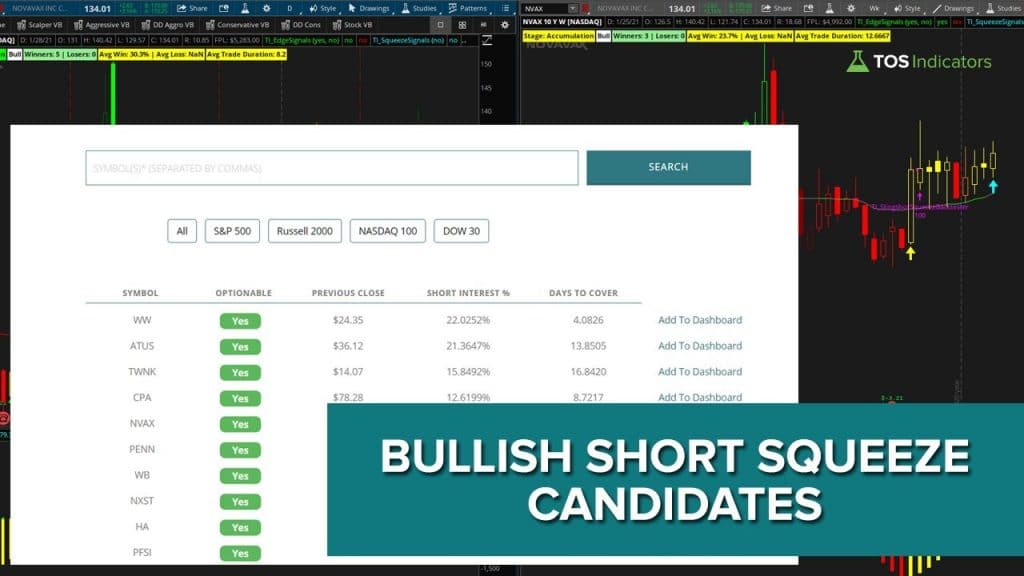

Read More5 Bullish Short Squeeze Candidates Supported by Technical Analysis

In this video, we’ll take a look at 5 bullish short squeeze candidates, that have a technical setup forming, supported by double digit short interest.

Read MoreSqueeze Setup in DLTR and Trade Update in AFL

We’ll setup a new squeeze trade in Dollar Tree (DLTR) which has won 4 out of 4 times, over the past 5 years.

Read MoreVisa (V) vs. Mastercard (MA) – Which Looks Stronger?

With today’s selloff in Visa and Mastercard, we’ll take a look at both charts with a longer term perspective in mind, for trade opportunities.

In terms of pure price movement moves, Mastercard was down 5.60% today, while Visa was down 3.58%. If we layer on a component of volatility, Mastercard was clearly the more volatile stock today.

We broke through both our Aggressive and Conservative Volatility Box models, suggesting that the sellers have full control in Mastercard. On the opposite side,

Read MoreBullish Squeeze Trade in Aflac (87.5% Winner Over the Past 5 Yrs)

There’s a bullish squeeze trade pattern setting up in Aflac (AFL) that has won 7 out of the past 8 times it has triggered (looking at a 5-yr period).

Read More