Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

Aggressive Trades For When Volatility Takes a Break

A step-by-step guide on how to handle a contraction in the VIX, when volatility takes a break.

How to Determine Volatility 30 Minutes After Market Open

A step-by-step guide on analyzing volatility 30 minutes after the market opens, every single day.

Adding a Trading Assistant to the Volatility Box

A step-by-step guide on how to add the trading assistant to the Volatility Box.

Day Trading /NG Futures for a Small Profit +$100

A step-by-step guide on how to trade natural gas futures and profit consistently.

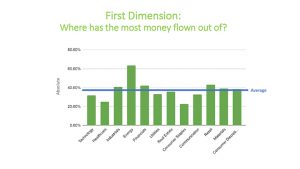

Global Market and Sector Data Breakdown

An in-depth breakdown of the Global Markets and Sectors, after the COVID stock market crash.

Volatility Trading Futures – ES, NQ, YM, and RTY (March 19, 2020)

A step-by-step guide on how to trade volatility in the index futures to consistently profit.

Trading Bounces in QQQ and MDT with Conservative Volatility Models

A step-by-step guide on how to use the Conservative Volatility Box to trade QQQ and other stocks.

Limit Down Patterns in the S&P 500

A step-by-step guide on how to recognize and profit from repeating limitdown patterns.

QUICK Day Trading Setups in SPY and DIA

An example of a simple day trading setup that you can use to trade index ETFs like SPY, QQQ and DIA.

Learning From Our Stopped Out Trades

Getting stopped out can often lead to some helpful trading lessons. Let’s take a look at how to analyze trades post-mortem.

Volatility Trading in Indices After Markets Go Limit Down (Mar. 9, 2020)

A step-by-step analysis of the volatility in index futures markets after a limit down day.

Day Trading Futures – Volatility Box Step by Step Walk-Through (Mar. 6, 2020)

A step-by-step walkthrough on finding the highest probability setups to day trade index futures.

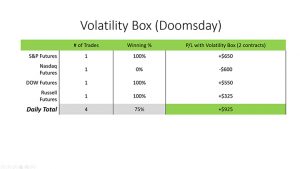

How We Are Adapting to Current Market Volatility +$925

A step-by-step guide on how to take advantage of volatility inside of index futures markets.

S&P 500 – March 2020 – FREE Report Included

A step-by-step guide on how to take advantage of the March 2020 COVID volatility, and how to profit from it.

Trades in ES, YM and RTY after Fed Benchmark Rate Cut +$3,150 on HIGH Volatility

Analyze the volatility post the fed rate cut in 2020, and how to profit from the index futures.

S&P 500 Drops and Trade Setups in XLU, XLP and GLD (Feb. 2020)

Analyze ETF setups in XLP, XLU and GLD to identify the best trades for both day and swing tading.

Quick Day Trade in INTC After Daily Squeeze Fires

A step-by-step guide on how to take advantage of the volatility inside of technology stocks like Intel (INTC).

Where to Focus When Indices Gap Down After Coronavirus Volatility

A step-by-step walkthrough of day trading the index futures right after the Coronavirus March 2020 volatility.

3 Trade Ideas for High Volatility Days

A step-by-step walkthrough on how to profit from high volatility days consistently.

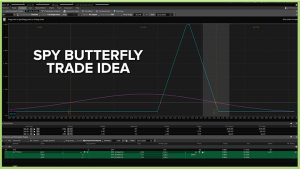

SPY Butterfly Trade Idea to Play the Put Call Ratio

A step-by-step guide on how to build a SPY options butterfly trade, using probabilities and statistics.