Volatility Box Trade Examples

Volatility models to help you trade stocks and futures like a seasoned professional

Day Trading the Nasdaq Futures

We have a systematic process that we follow every single day, for day trading with the Volatility Box.

Using the note we sent out at 7:30 am PT to all of our members, we’ll cover the Nasdaq and Copper futures markets, where we had trade opportunities set up today.

Specifically on the Nasdaq futures (NQ), we had 3 different setups that met our Trade Plan rules, and triggered. All 3 of these were winners, for a net P/L of +$1,560.

On the Copper futures (HG), we had one trade setup which took

High Short Interest and Bullish Squeeze in Lumentum (LITE)

In less than 5 minutes, we’re going to scan through 60 stocks to find high short interest trade opportunities (using the weekly time frame).

The scan that we use in today’s video is our Edge Signals scan, looking to find places where we had the signal print bullish with last week’s close. We also overlaid a squeeze condition on top, looking for a squeeze likely to fire long.

Using that list, we have these 4 stocks, that looked interesting and had relatively high short interest:

IFF,

VCTY,

T

Day Trading TSLA, NFLX and 8 Other Stocks

We’re going to talk about 10 day trading setups that we had today via the Stock Volatility Box platform (including TSLA and NFLX).

Imagine outsourcing all of the work of finding trades to a machine, and then getting to pick and choose your favorite symbols? Well, with the Stock Volatility Box platform, we’ve built a powerful Live Scanner, which is constantly scanning the market every 15 to 20 seconds, to look for Volatility Box edge entries.

Using the Live Scanner, we had 117 total trades th

Fades in the YM, RTY and NG Futures

We had three markets in which we had Volatility Box breaches today – the DOW, Natural Gas and Russell futures markets.

In the morning, we sent out a note to all of our members with a list of all 9 futures markets we look at, along with the Volatility Box models we were using for the day. These models are selected based on the First Hour test, and we let price action dictate to us if and when we should switch.

We had a total of four trades that set up today:

1. A long fade in Natural Gas (win

SPY, QQQ, DIA and IWM Buy Zones and Triggers

We saw a broader sell off in the indices with Friday’s trading, leading many top weighted holdings to start to pull back to entry zones.

In this video, we’re going to use a few different perspectives (and indicators) to create a game plan, with specific levels that I’m interested in buying as support on the SPY, QQQ, DIA, and IWM.

We’re going to use the following tools for the analysis:

1. Put Call Ratio in the Utility Labels

2. Market Pulse Line

3. Fibonacci Retracements and Extensions

4.

Expecting a Trending Down Day in Nasdaq 30 Mins After the Open

We had an early heads up to expect a trending day in the Nasdaq (/NQ), Copper (/HG) and Crude Oil (/CL) futures markets.

The Nasdaq was the clear winner for the day, but all 3 markets made moves in their respective trending directions. We had our notification at 7am PT that we should expect a likely trending day in the NQ futures.

At that point, the Nasdaq was trading closer to 10,100. By the end of the day, the Nasdaq had traded down to 9,927.25. That’s a move of ~1.7%+, which had significa

Trading Psychology – S&P vs. Nasdaq Futures (Winner vs. Loser)

Trading psychology, and managing emotions throughout a day, is often times the difference maker between a good and bad day.

As traders, our job is to follow our Trade Plan rules and execute trades that meet conditions in which we have a probabilistic edge. However, this is usually much easier said than done, as emotions and human nature to avoid loss / rejection starts to take over.

Mark Douglas’s Trading in the Zone is one of the best books on trading psychology, and truly training the mind

Finding Trade Opportunities in the Dividend Aristocrats

The Dividend Aristocrats is a list of S&P 500 stocks, that have been increasing their dividends for 25+ consecutive years.

The full list is available for free download: https://www.suredividend.com/dividend-aristocrats-list/

This gives us an instant list of high quality stocks, where we can start to look, to find opportunity when most everything else in the marketplace feels extended. There are currently 66 stocks on the Dividend Aristocrats list (June 2020), and we’ll be focusing on one in p

2 Setups in the 30-YR Bond and Weekend Trade Updates

Our Trade Plan rules typically keep us on the right side of the market. In today’s case, we ended up being TOO cautious with our rules, at the expense of missing multiple setups in the 4 major indices markets, almost all of which worked.

However, our rules usually do keep us out of trouble — which was proven in our 2 setups in the 30 Year Bond futures market (/ZB). In our first setup, we hit both our first and second target, giving us a nice win.

The second setup was a little different, tho

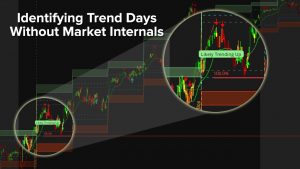

How to Easily Identify a Trending Day (Before It Sets Up)

Trending days are some of the most powerful ones, if you know the signs for which to look out.

Unfortunately, more times than not, keeping track of things like the market internals ($TICK, $ADSPD, $PCVA, etc.) can be overwhelming, and lead to analysis paralysis with no real action.

The Volatility Box makes identifying a Trending Day super easy – a chart bubble pops up notifying you to expect a likely trending day. It’s that easy. In the case of the /ES futures, we had the heads up at 7 AM PT

Trading FSLY, ZS and JNJ On a Down Day

On a day in which the S&P was down 5.43%, we still found a way to be profitable with both long AND short setups using the Volatility Box.

In today’s video, we’re going to revisit the 6 takeaways that we had discovered in the “Analyzing Friday’s Stock Market Flow” video (linked below):

https://www.youtube.com/watch?v=hhzAhWK8zKs

We’ll go through a handful of trades using the takeaways and observations that we’ve been discussing in these Trade Report videos. For example, we discovered that 6:3

Ranking Volatility in ES, YM, NQ and RTY Futures

We show you how to rank the 4 major index markets and their respective volatility, in just a few minutes.

As part of our Volatility Box Trade Plan, we have our first hour test, which helps us determine and adapt to the day’s volatility. In today’s case, what we noticed was the DOW and Russell futures giving us signs of being the more volatile markets, while the Nasdaq was on the opposite end of that spectrum.

We perform the First Hour Test for our indices at 7 AM PT, less than 30 minutes into

Managing a Small Loser in the S&P 500 Futures

We’ve had a nice winning streak with our futures trading over the past few weeks, which ended today with a small loser in the S&P 500 Futures. We also discuss a couple trade setups in COST and KR.

Our Trade Plan is designed with a set of rules in mind to keep us out of trouble, more times than not. In the case of the /ES futures, our rules did just that. We had an opportunity to short the S&P 500 as the markets slammed into our Volatility Box levels in the 10-11 am PT hour.

However, we did n

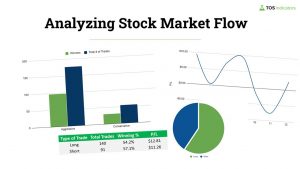

Analyzing Friday’s Stock Market Flow

We’re going to use all 231 Volatility Box trade setups to chart out Friday’s stock market flow, to see if there are any interesting patterns that stand out.

We’ll compare things like the Aggressive vs. Conservative Volatility Box models, along with answering some common questions, such as “Is there a specific time of day that’s better for trading stocks than others?”

There are 6 different dimensions that we’ll use for this analysis:

1. Aggressive vs. Conservative

2. Long vs. Short

3. Combine

Day Trading the Russell and Copper Futures +$1,580

The Russell Futures (/RTY) has been more volatile than its index peers as of recently, which has also led to us finding some really nice Volatility Box fades.

We had a nice winner earlier in the week, and that same trend continued today. In the Russell futures, we had two trade setups that triggered, both of which were winners. One was via our new Scalper Volatility Box, while the other was via the Conservative Volatility Box.

The first day trade in the RTY futures was good for +5.6 points, w

High Short Interest Update in CHWY and PETS

Over the weekend, we set up trades in CHWY and PETS, with the help of our new short interest scanner.

Both CHWY and PETS had high short interest, but we also had some key executives selling their shares. This gave us a reason to be cautious, and set up more of a hedge-type trade, as opposed to an outright directional play.

Our final trade was looking for a bullish move in CHWY, with a bearish hedge in PETS, which was the weaker of the two charts.

Since making the video, CHWY has increased +1

Short Entry in the Russell Futures +$820

We had one entry in the Russell 2K (/RTY) futures today, at 7:40 AM PT, which led to a nice winner of +$820 across both contracts.

The short came in the RTY as price slammed into our Volatility Box, levels giving us an opportunity to try and scalp the markets. Our risk was 4.8 points, to try and make 4.8 points on the first contract, and 11.6 points on the second contract (with a break-even stop).

Once we got our Edge Signal confirmation, that was the green light to enter the trade, with a s

Scanning for High Short Interest Trade Opportunities

A step-by-step guide on how to scan for high short interest in 13,000+ stocks and ETFs.

Short Trade Setup in Shopify (SHOP) +3.5%

Start trading with an edge, at the edge, and sign up for the Volatility Box today

Futures Volatility Box – Mid Day Walk Through of 4 Indices

Start trading with an edge, at the edge, and sign up for the Volatility Box today