Posts Tagged ‘free tutorials’

Backtesting the Put-Call Ratio and Transports Over a 10-Year Period

Backtest the $PCALL ratio and $DJT transports over a 10-year period, to understand how these signals have performed historically.

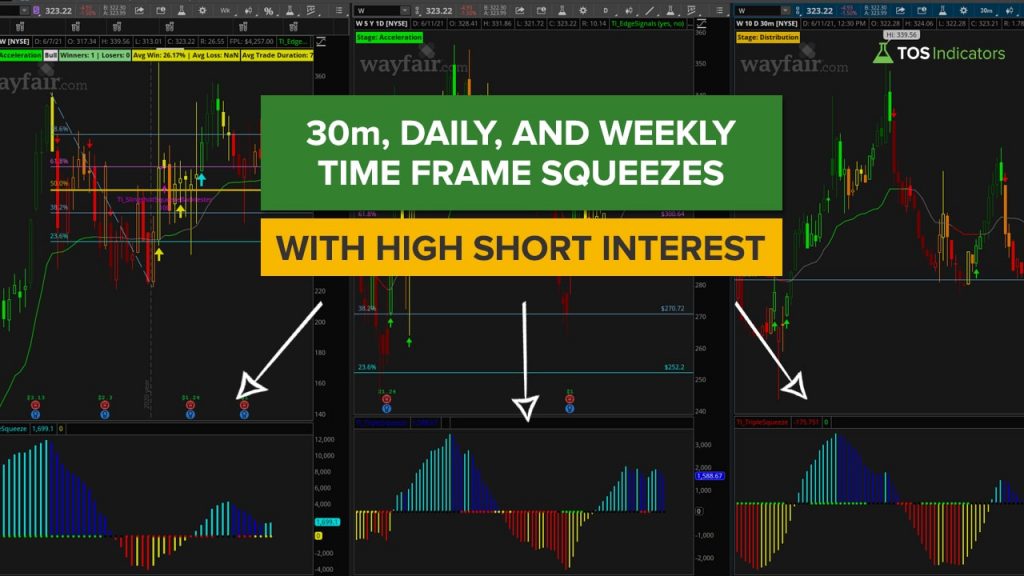

Read More30m, Daily and Weekly Squeezes with High Short Interest

In this video, we’ll write some simple thinkScript code to find stocks that hit their YTD high and low on Dec. 31, 2020.

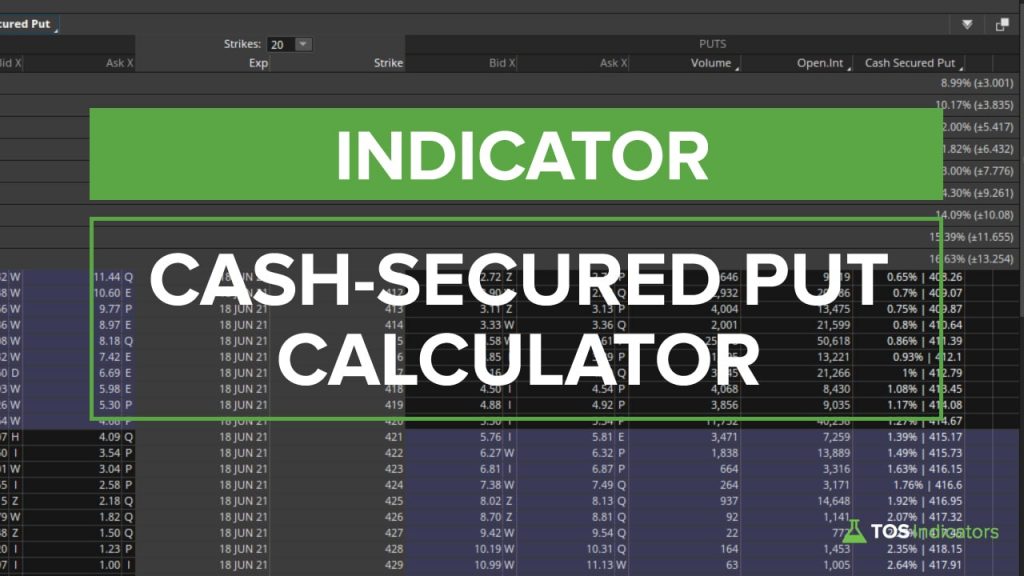

Read MoreCash-Secured Put Calculator

The Cash-Secured Put Calculator helps you quickly calculate return percentages and identify the best stocks to sell cash-secured puts.

Read MoreMarket Pulse Dashboard

The Market Pulse Dashboard lets you quickly assess the market trend on a large list of stocks, across a variety of different time frames.

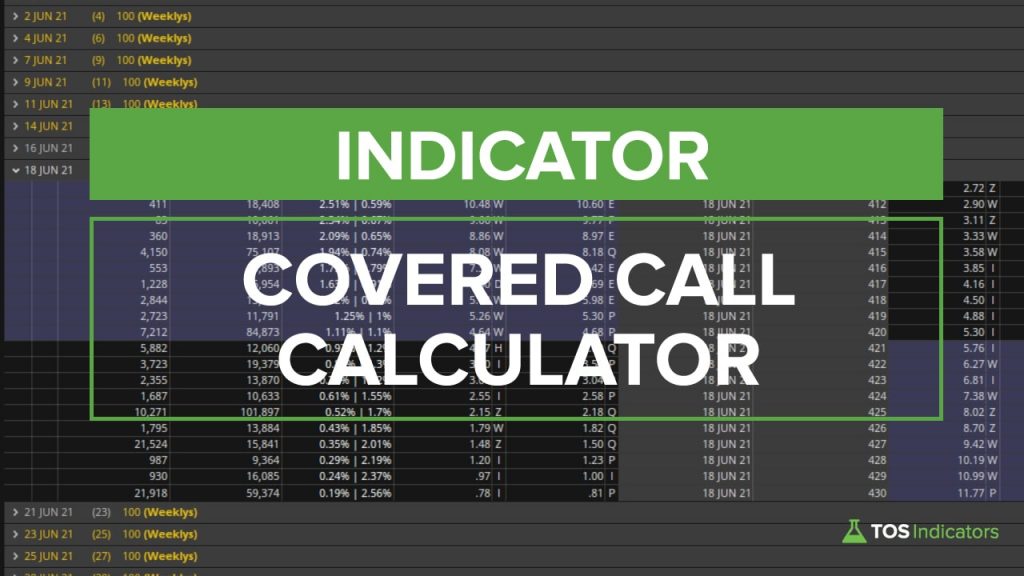

Read MoreCovered Call Calculator

Build a simple, yet powerful Covered Call Calculator for ThinkOrSwim to find the most profitable calls to sell.

Read MoreReversion to 50 Day SMA

Learn how to build a “reversion to the mean” type indicator, using boolean variables and labels.

Read MoreWilder’s Momentum Concept

Explore the multi-decade old momentum concept created by Wilder, using a few, simple lines of code.

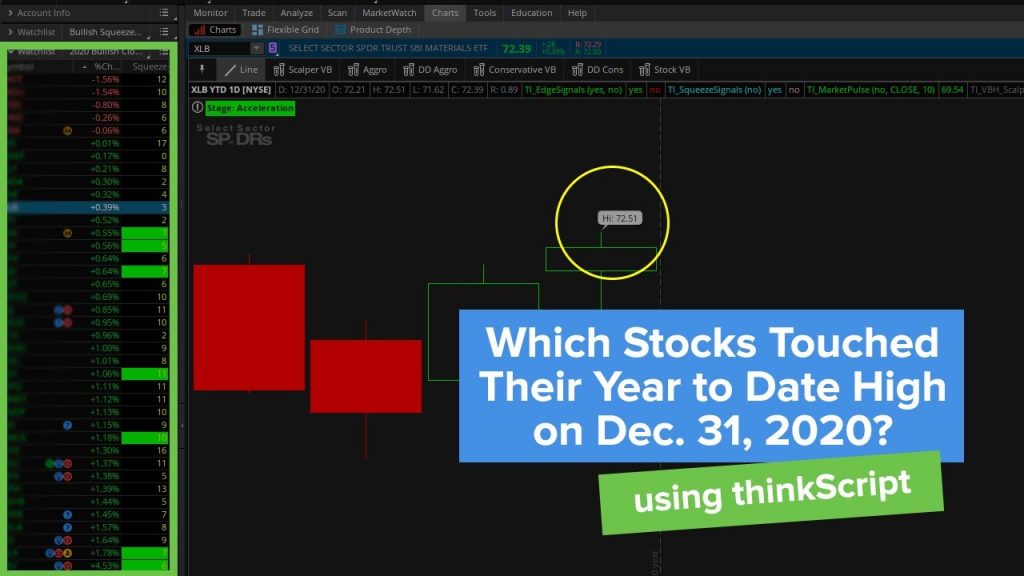

Read MoreHow to Scan for Stocks That Hit YTD High on Dec. 31?

Learn how to build a custom scan to find stocks making their YTD high on the last trading day of the year.

Read MoreMoving Average Crossover Backtester

Test which moving average crossover is best on your favorite list of stocks, ETFs and futures markets.

Read MoreUpcoming Earnings with High Short Interest

Build a scan to find stocks that are likely to have a run up into earnings, based on short interest and price action.

Read More