Beat the Market Makers

Turn ThinkOrSwim into your trading powerhouse, with our free indicators, scans, backtesters, research and more.

100+

Indicators, scans, and backtesters

65-75%

Average win rate across setups

34,000+

Data points analyzed every single week

How We're Different

Our mission is to empower you to become an independent trader. We show you how to build your own tools (from scratch), and piece them together to create trading strategies that work for you (and your trading style).

While most of our competitors charge hundreds (and sometimes thousands) of dollars for "game-changing indicators", we give away most of our tools for 100% free.

Average True Range

Use the Average True Range to find stocks with high and low volatility, triggering high probability setups.

Parabolic SAR

Build a better Parabolic SAR indicator, that allows you to predict reversals before they happen.

Monthly Watchlist Scan

A powerful scan that finds you the best seasonality patterns and trends, every single month.

Smarter MACD

Learn how to build a powerful MACD indicator with built-in higher time frame analysis. Download for free on our website!

Candle Counter

Download this free indicator to easily analyze your favorite markets, and compare red vs. green candles to find patterns and trends.

Moving Average Clouds

A simple, yet powerful Moving Average Clouds indicator, to easily spot trends and reversals. Free download!

TTM Squeeze Dots

Scan for five TTM Squeeze dots in a row, with stacked moving averages. Download the shared links for free, and learn how to build your own scans.

Dividend Yield

Analyze the current dividend yield vs. the historical yield in your favorite markets, and find hidden gems with outperformance.

Stacked Moving Averages

Scan for bullish and bearish stacked moving averages with our free scans. Download the shared links for free, and learn how to build your own scans.

Stacked Moving Averages

Find the best trends with our free Stacked Moving Averages indicator. We’ll show you how to build it, and use it with your favorite EMA’s and SMA’s.

Average Volume Stats

Analyze and compare today’s daily volume with historical volume in less than 1 second.

Super Bowl Indicator

Build your own Super Bowl indicator, and test how useful it has been in predicting stock market moves.

Bollinger Bands Reversal

Build your own Bollinger Bands reversal indicator, by taking advantage of a popular reversal pattern.

Santa Claus Rally Backtester

Backtest how often Santa Claus Rally occurs in the S&P 500, and all of your favorite markets.

Price to Book Value Ratio

Track the current and historical P/B ratio levels for any market, using our free P/B Ratio Indicator for ThinkOrSwim.

Upcoming Earnings Scan

Learn how to scan for upcoming earnings in ThinkOrSwim using two simple methods.

Multiple Time Frame Moving Averages

Add different timeframe moving averages to a specific chart, using a few lines of simple thinkScript code

TTM Squeeze Histogram Backtester

Backtest the TTM Squeeze Histogram on any market, to measure how effective the histogram is with timing momentum shifts.

SPY Meltdown Backtester

Backtest what tends to happen in after a massive sell-off in the markets. Do we see continued selling, or do buyers have a short-term rally?

Relative Performance Indicator for ThinkOrSwim (FREE)

Build a relative performance indicator, which lets you easily compare two symbols against each other and find outperformers

Our Signature Tools

We're a small team of data scientists and engineers, passionate about discovering hidden edges in the markets.

Stock Volatility Box

10,000+ Stocks and ETFs supported

Futures Volatility Box

10,000+ Stocks and ETFs supported

Opening Range Breakouts

13,000+ stocks and ETFs supported

Volatility Box models

Volatility Trading, Simplified

Profit from hidden quant-based levels in the markets, with our easy-to-read Volatility Box models.

We study 34,000+ data points every week, and build predictive models to help you pinpoint the best entry and exit prices for stocks, futures, microfutures, and ETFs.

Volatility Box Membership Includes:

We do our best to make the Volatility Box a no-brainer decision. It is an all-inclusive membership, that includes all of our premium indicators, courses, and ThinkOrSwim tools.

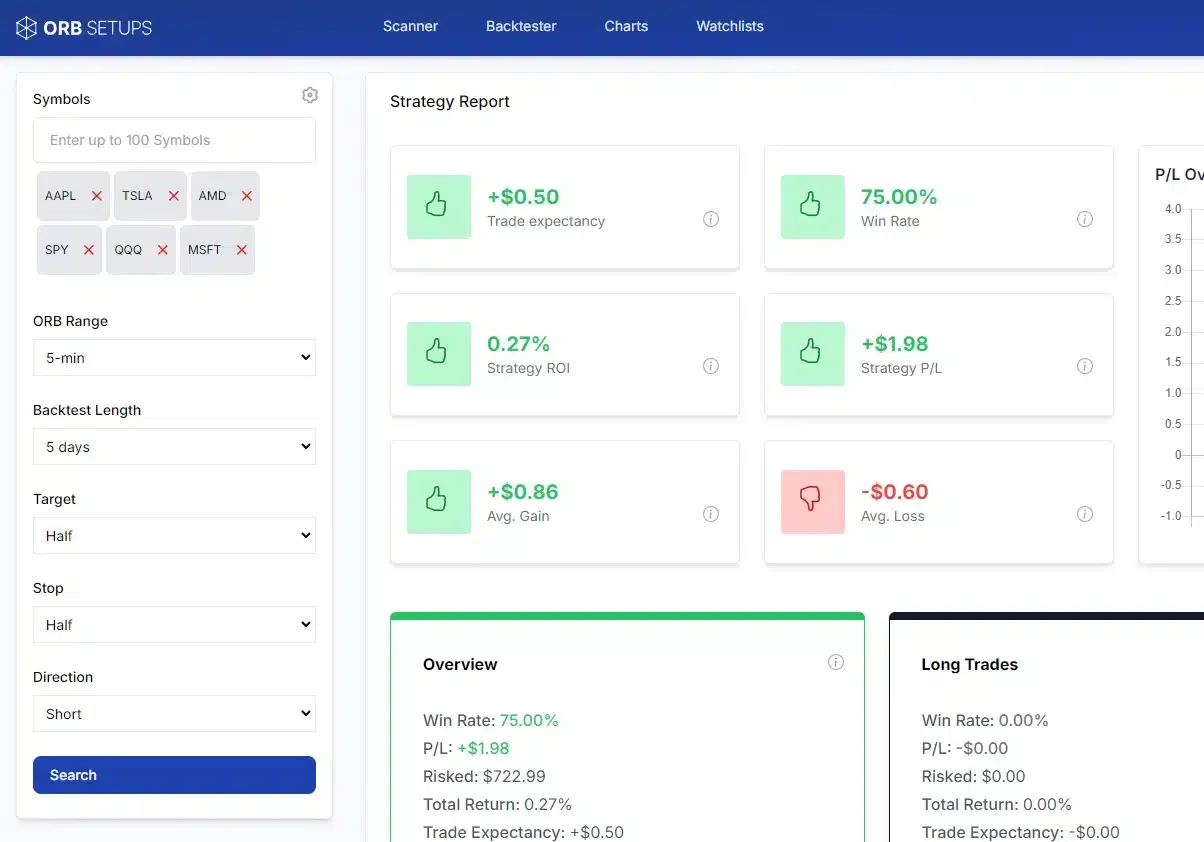

Opening range breakout platform

Find the Best ORB Setups

The ORB Platform combs through more than 150,000 setups every morning, to find you the best opening range breakouts triggering real-time.

ORB Live Scanner

Instantly find the best setups real-time, with built-in backtests

ORB Backtester

2+ years of intraday data to analyze win rates, P/L, and trade expectancy.

Detailed Trade Cards

Easy-to-read score cards to decide whether to trade or skip.

Optimized Charts

Fast, lightweight charts tailored specifically for the ORB strategy.

Why 35,000+ Traders Use Our Indicators

I create my watchlist every week, and sell ATM spreads whenever I get alert notification. Great setup for weekly income

Jyoti S.

Stock Volatility Box

Really loved the service, it's been awesome-I've loved the weekly updates, and additional edge that the tools have provided.

Danny K.

Volatility Box Bundle

It is actually the only setup where I have consistently made profits day trading futures. So keep up the good work.

Kent P.

Futures Volatility Box

You are a godsend! I don't know coding like this but recently I've been learning about the TTM squeeze and stacked MAs. I am just so grateful you took the time to explain everything in such great detail.

Kirkhart S.

TTM Squeeze Dashboard

Amazing work!!! I love watching your scripting videos and learn to try my own variations when possible. I have to say if it was not for your videos I would have either gave up trying to script or paid for the indicators.

Nick P.

Simple Breakout Tool

Thanks for sharing. You are the best site to learn thinkscript.

Kasu S.

Advanced VZO

Thank you much! This was exactly what I've been wanting to add to my TOS charts. Appreciate your work!!

Graham M.

Moving Average Clouds

You put out the best TOS thinkScript tutorials. Keep them coming!!!!

Konstantin B.

TTM Squeeze Dashboard

Our Latest Trade Reports

We aim to publish videos 2-3x a week, with new trade ideas, research, and tutorials.

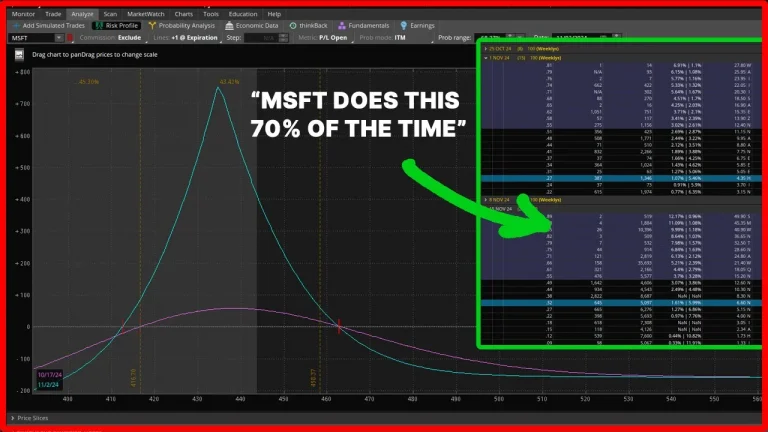

Microsoft Pre-Earnings Options Strategy

Microsoft has a predictable pre-earnings pattern, and here is one options trade idea to take advantage of it.

Watch NowHow to Recognize When a Trend Reverses

Classic price and volatility clues to recognize when a trend is exhausting and you should avoid buying any more dips.

Watch NowIs This a Sign to Buy Copper Stocks?

Is this new trend your sign to buy copper stocks? Let’s backtest the setup, and see which copper stock is worth trading.

Watch Now